Tax treatment for homeowners who generate solar energy for personal use In most countries, including the United States, homeowners who generate solar energy for personal use do not have to pay taxes on the energy they generate. This is because the electricity generated by a home solar energy system is considered a personal use item… [Read More]

What Are Federal Solar Credits And How To Claim Them In Tax Returns?

The federal solar tax credit, also known as the Investment Tax Credit (ITC), will be at a reduced rate in 2022 and beyond. To claim the federal solar tax credit, you will need to file IRS Form 5695 “Residential Energy Credits” with your federal tax return. You will also need to provide documentation of the… [Read More]

Retiree Tax Break for Georgia Seniors

In-migration of retirees is a significant driver of economic growth As shared by the Atlanta Journal Constitution, a tax break on pensions and other retirement income for Georgia seniors will cost the state — and save retirees — about $1.37 billion this year, according to a new state audit report. The audit report by Robert Buschman… [Read More]

Georgia Storm Victims Qualify For Tax Relief

Individuals and businesses in a federally declared disaster area According to an IRS announcement, storm victims in parts of Georgia now have until May 15, 2023, to file various federal individual and business tax returns and make tax payments. The IRS is offering relief to any area designated by the Federal Emergency Management Agency (FEMA). The… [Read More]

Georgia Residents Can Now Claim A Fetus As A Dependent On Their Tax Returns For A $3,000 Exemption

Georgia Will Give You A $3000 Tax Cut For Your Fetus The state’s “fetal personhood” provision now includes a $3000 tax exemption starting at around six weeks of pregnancy. As informed in a previously article, once the Supreme Court reversed Roe in June 2022, many expected the courts to revisit Georgia’s law. That effectively happened in… [Read More]

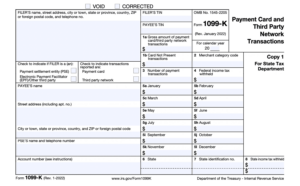

If I Have A Holiday Craft Business, Will I Receive A Form 1099-K?

Yes, you may receive a Form 1099-K depending on the type of transactions. According to the IRS, if you accept payment cards (for example, credit card or debit cards) as a form of payment for goods you sell or services you provide, you will receive a Form 1099-K for the gross amount of the payments… [Read More]

File your 1099 Forms With Daniel Ahart Tax Service [Infographics]

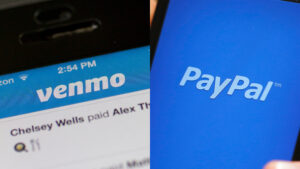

How to Handle a 1099-K for Personal Payments

Venmo and PayPal Tax Reporting Change Many Americans are bracing for a new reporting change for third-party payment networks like Venmo or PayPal. Starting in 2022, you’ll receive Form 1099-K, which reports income to the IRS, for business transfers over $600. If you receive a 1099-K for business transfers, you’ll also report that income, along with… [Read More]

Steps You Can Take Now to Make Tax Filing Easier In 2023

Planning ahead can help people file an accurate return and avoid processing delays that can slow tax refunds. As wrote in a previous blog “What About a Tax Checkup?,” this is also definitely a good time for filers to prepare for next year’s tax season by reviewing withholdings, retirement contributions, child tax credits, unemployment income and more…. [Read More]

You Can File Your Tax Return Any Time Before the Extension Expires On October 17, 2022

Don’t Miss Your Tax Deadline If You Requested An Automatic Extension Earlier This Year You needed more time to prepare your federal tax return? Fine, now it’s the time to file, as long as you requested before April 18, 2022 an automatic extension of time to file your U.S. individual income tax return. The IRS encourages… [Read More]

$500 Property Tax Break Proposed by Kemp

Kemp proposed a second round of tax refund checks and restore a property tax break that hasn’t been activated by the state legislature since 2008. Did you know that Brian Kemp announced last August 11, 2022 that he will seek a second round of tax rebate checks to Georgia taxpayers and the return of a… [Read More]

Home Financing Calculators

Visit this page to use the Home Financing Calculators Did you know that using bi-weekly payments can accelerate your mortgage payoff and save you thousands in interest? Also, do you know the APR on your adjustable rate mortgage? Use these home financing calculators to help determine whether you should buy or rent, and much more!… [Read More]

- « Previous Page

- 1

- 2

- 3

- 4

- 5

- 6

- …

- 8

- Next Page »