Take Care of your Crypto Taxes in 5-Easy Steps

- Create a CryptoTrader.Tax account – Crypto Taxes Done In Minutes

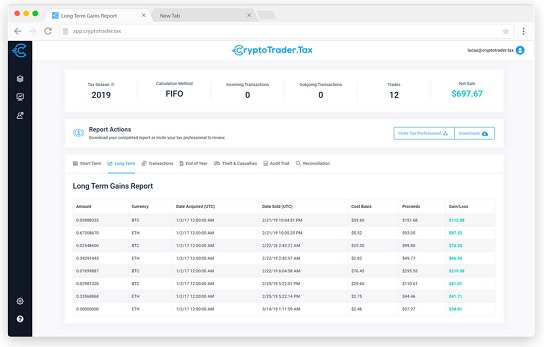

- Import Your Trades

- Add Crypto Income

- Generate Your Report

Then, after you generate your report, you have two options:

- Bring it with your other tax documents to one of our Daniel Ahart Tax Service office locations for expert tax preparation

- File with us online with one of our crypto tax experts

The Ultimate Crypto Tax Guide

Do you know what are my crypto tax obligations for the 2024 tax year? Join the thousands of individuals in the State of Georgia that trust their taxes to Daniel Ahart each year!

- The Basics of Crypto Taxes: What is Virtual Currency?

- When Do You Owe Taxes On Your Crypto?

- When Don’t You Owe Taxes On Your Crypto?

- How Do You Calculate Your Crypto Taxes?

Not a Client Yet? Let’s Schedule An Appointment to Discuss Your Business Needs

Virtual appointments are encouraged so that we are able to limit the number of people in our office. Our Virtual “No Touch” Tax Prep service is the easiest, contact-free ay to have your return prepared by one of our experts. If you do come in person though, we ask that you come by yourself or with your business partner. Don’t bring extra people.

Use our tool to find the office nearest you or click on a city link below. You will find office information and a link to schedule and manage your appointment on the office page.

Search For An Office

Select office for contact information or to schedule an appointment.