File a Tax Extension

A filing extension is an exemption that can be made to an individual or to a business’s taxpayers that are unable to file a tax return to the federal government by the due date.

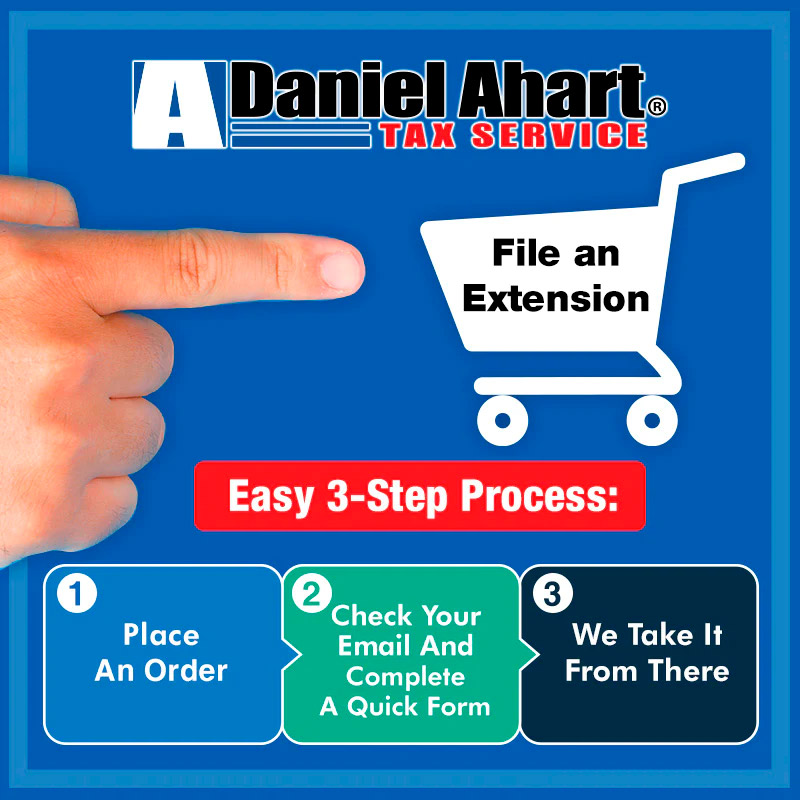

If you think you won’t be able to complete your federal tax return by the filing deadline, we recommend you to file an IRS extension.

Below Important deadlines to file an extension according to your situation:

- Extension for Business Taxes March 15th

- Extension for Personal Taxes April 18th

It’s important to mention that an extension only pushes back the due date for the filing of your tax documents and it does not give you extra time to pay on any taxes you may owe. Once you have filed an extension, you will have until October 15 to finish your filing.

Disclaimer

Your tax extension is confirmed when is sent to the IRS, not when you notify to us. So make sure you contact us with at least one week in advance.

In addition, if you believe you will owe money, you’ll need to estimate the amount after filing for an extension and make a payment by the filing deadline (March or April 15th).

Not paying on time or enough, or failing to file altogether, may cost you:

The IRS will charge you interest on the unpaid balance until you pay the full amount, when you don’t pay the full amount you owe,

When you don’t pay at least 90% of the amount you owe, you might also be subject to a late payment penalty. The penalty is usually half of 1% of the amount owed for each month, up to a maximum of 25%.

If you don’t file either your return or an extension form by the filing deadline, you’ll be subject to a late filing penalty. The penalty is usually 5% of the amount you owe for each month, up to a maximum of 25%.

Do I need to file an extension for the State of Georgia?

NO, You do not need to request an extension to file your Georgia return if you receive a Federal extension. The due date for filing your Georgia return will be automatically extended with an approved Federal extension.

If you have questions, work with our Tax experts to submit your tax extension and get more time to file your tax return.